per capita tax definition

Low levels of GDP per capita and the need to boost economic growth also push Governments to limit the tax burden on the private sector thus making use of tax exemptions and holidays. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

Define Per capita potential county ad valorem tax revenue.

. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Presbyterians have used per capitaan annual per member apportionment assessed by the General Assembly Book of. For most areas adult is defined as 18 years of age or older.

Failure to pay the daily per-capita tax will result in immediate expulsion from Gateway. The school district as well as the township or borough in which you reside may levy a per capita tax. Per capita income is national income divided by population size.

For example if you want to know how many people have blue hair per every X amount of people in a certain population you would first. Match all exact any words. It means to share and share alike according to the number of individuals.

Can I have a copy sent to me. Table 2 lists the per capita dollar amounts of total tax burden and income that are divided to compute each states burden as well as the breakdown of in-state and out-of-state payments for calendar year 2022. It is not dependent upon employment.

In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid councils presbyteries and synods across the country. Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. My billaccount information is incorrect eg addresslast name.

It can apply to the average per-person income for a city region or country and is used as a means of. Define Net tax per capita. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will.

By or for each individual a high per capita tax burden. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Can I request a correction. Is this tax withheld by my employer. Both taxes are due each year and are not duplications.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Take the following steps to calculate the per capita of a particular situation. UN-2 Estimated at 105 of income North Carolinas state and local tax burden percentage ranks 23rd highest nationally taxpayers pay an average of 3526 per.

As a result the residents of all states pay surprisingly high shares of their total tax burdens to out-of-state governments. Per unit of population. I moved and no longer live in this area.

Used primarily in economics PCI utilizes average income to calculate and present the standard of living and quality of life for a population or area in study. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. More specifically according to the United States Census Bureau it is the money earned by every man woman.

Per Capita means by head so this tax is commonly called a head tax. Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. Per capita Unit Number of people in a population.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Well income per capita is basically the amount of money per person in a specific area. Normally the Per Capita tax is NOT.

Determine the number that correlates with what you are trying to calculate. Income per capita is a measure of the amount of money earned per person in a certain area. I lost my bill.

Why did I receive a per capita tax bill. Do I pay this tax if I rent. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district.

A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period.

For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. As of the amount for each municipality concerned is assessed in proportion to its per capita tax capacity. Means the adjusted net tax capacity of all taxable real property in the city or town or county divided by the total population of that city town or county.

In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent. Means the total assessed value within each county for the 2014 tax year multiplied by twelve 12. What is the Per Capita Tax.

I did not receive my per capita tax bill. Per capita income is often used to measure a sectors average income and compare the. It is calculated by dividing the areas total income by its total population.

In other words if you. Under a per capita distribution each person named as beneficiary receives an equal share. Definition in the dictionary English.

Can you provide me with my invoice number so that I can make a payment online.

Per Capita Income Calculation Examples What Is Per Capita Income Video Lesson Transcript Study Com

Property Tax Definition Property Taxes Explained Taxedu

Information About Per Capita Taxes York Adams Tax Bureau

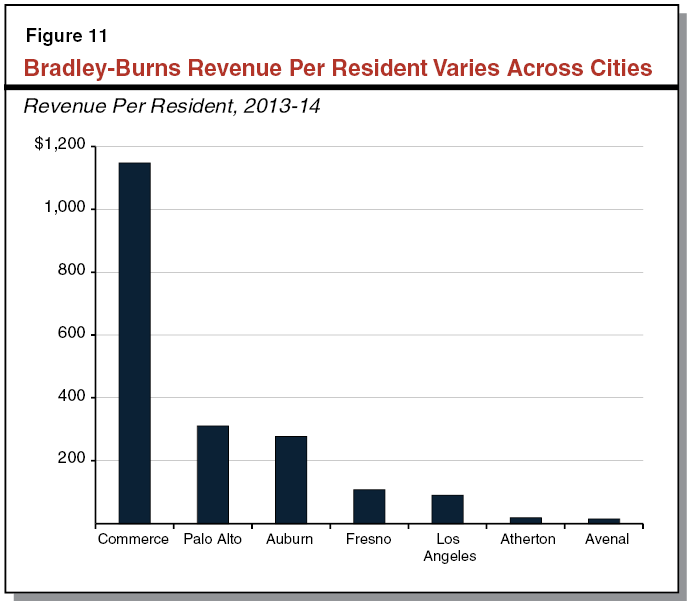

Understanding California S Sales Tax

Per Capita Definition Formula Examples And Limitations Boycewire

Property Tax Definition Property Taxes Explained Taxedu

How Is Tax Liability Calculated Common Tax Questions Answered

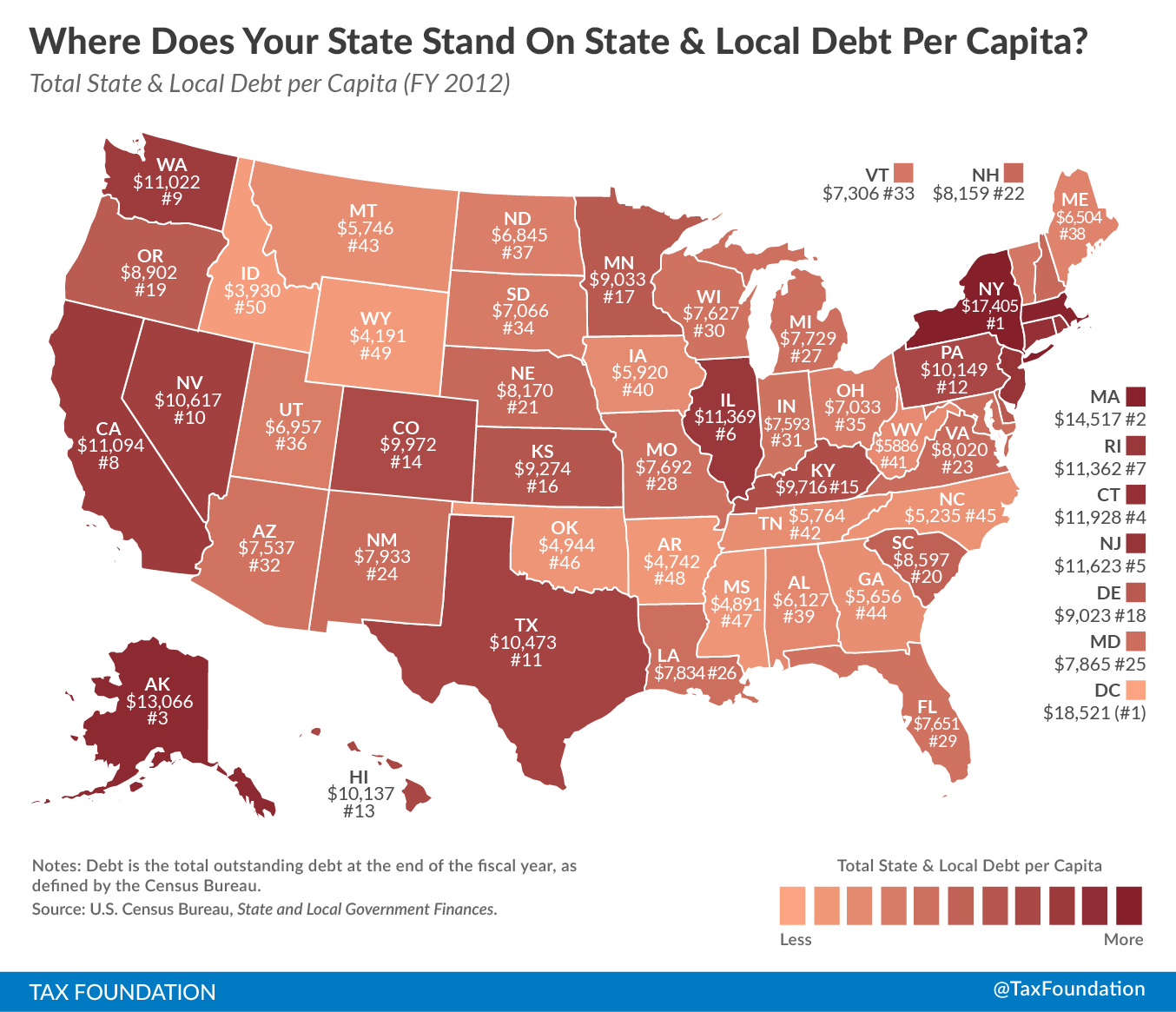

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Understanding California S Sales Tax

Property Tax Definition Property Taxes Explained Taxedu

Understanding California S Sales Tax

Hungary Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)